The analysis in the following

paragraphs is a clear example of soberness in contrast to the obsessive

irrationality and/or superstition prevailing in the Greek political scene. This

was taken from 'Fidelity Analyst Survey for 2013' publication without permission*.

The analysis in the following

paragraphs is a clear example of soberness in contrast to the obsessive

irrationality and/or superstition prevailing in the Greek political scene. This

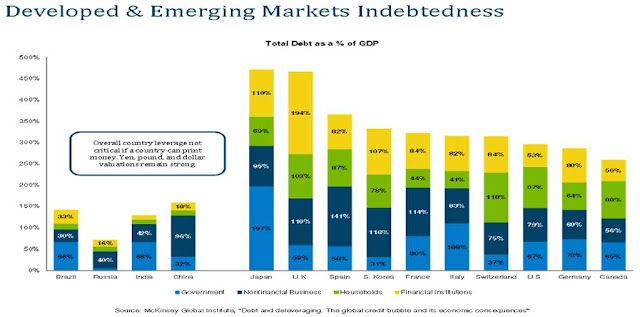

was taken from 'Fidelity Analyst Survey for 2013' publication without permission*.Deleveraging and it's consequences will be felt for a long time

}The period from the early 1980s to the mid-2000s, now often described as

the ‘Great Moderation’, was one when a number of disparate factors (such as

demographics, monetary policy and deregulation) combined to create a positive

environment that facilitated rising asset prices, coupled with generally lower

macroeconomic volatility. The same backdrop also led to an unprecedented

increase in private sector debt in the developed world. The collapse of the US

subprime mortgage market was just the first chapter of a much broader global

debt crisis that affected individuals, financial institutions and, ultimately, governments.

}From an individual’s

perspective, excess debt can usually be reduced by belt tightening. From a

national perspective, the belt tightening option, via cuts in public sector

jobs for example is widely known as ‘austerity’. However, this approach has attracted

criticism from those who argue it is counterproductive because of its negative

impact on economic growth which results in lower tax receipts and potentially deflationary

effects (something that effectively increases the real value of debt).~

And it continues elsewhere:

}Many European countries will likely endure sustained periods of low

economic growth despite low interest rates. This is because with high national

debt to GDP, many governments need to go through a deleveraging process that is

structural rather than cyclical in nature. This constrains their ability to

spend on upgrading their infrastructure, whether it is physical (such as rails,

roads, or power grids) or social (such as education and healthcare). Our analysts

expect consumption in Europe to suffer from low economic growth and household

deleveraging.~

*These }...~ paragraphs appear as they were in the report. Data charts are from other sources.

No comments:

Post a Comment

You can post your feedback or comment. Please remember to be polite and brief.